Receiving an Inheritance

Submitted by Parkhouse Financial / Portfolio Strategies Corporation on April 19th, 2017 How to Make the Most out of an Inheritance

How to Make the Most out of an Inheritance

Inheriting a significant estate can be a bittersweet experience. Typically, the passage of wealth comes with the passing of a loved one.

Protecting the financial well being of your family can also help you achieve the retirement lifestyle you deserve

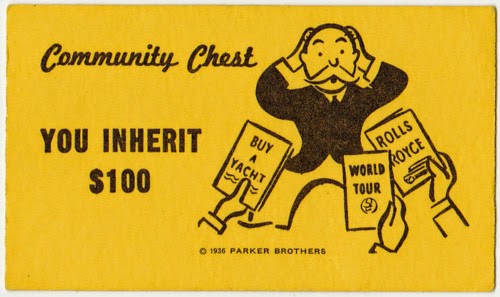

Protecting the financial well being of your family can also help you achieve the retirement lifestyle you deserve When it comes to retirement, our expectations for our target retirement age are continuously reflecting the reality that:

When it comes to retirement, our expectations for our target retirement age are continuously reflecting the reality that: Which type of goal planner are you:

Which type of goal planner are you: Now that most Canadians and their advisers have gotten the message across about the rising power of tax-free savings accounts (TFSAs), some are beginning to question whether RRSPs are even relevant anymore.

Now that most Canadians and their advisers have gotten the message across about the rising power of tax-free savings accounts (TFSAs), some are beginning to question whether RRSPs are even relevant anymore.