2023 Market Outlook

Submitted by Parkhouse Financial / Portfolio Strategies Corporation on January 18th, 2023

Even though life insurance won’t be paid out until you’re gone, many of the most affluent individuals in Canada – and around the world – see life insurance as an important part of their planning.

Even though life insurance won’t be paid out until you’re gone, many of the most affluent individuals in Canada – and around the world – see life insurance as an important part of their planning.

The right advice can bring your future into focus.

Retirement 20/20

Retirement 20/20

The 2017 Fidelity Retirement Survey Report

How to Make the Most out of an Inheritance

How to Make the Most out of an InheritanceInheriting a significant estate can be a bittersweet experience. Typically, the passage of wealth comes with the passing of a loved one.

Retirement Planning

Retirement Planning

Investments

Group Benefits

Life & Disability Insurance

Nathan Parkhouse, CFP, CIM, FMA

Founder & Financial Advisor

121 King St W, Suite 2140

Toronto, Ontario

Phone: 416.838.3617

Nathan@ParkhouseFinancial.ca

www.ParkhouseFinancial.ca

Thank you to all of our clients and friends for a terrific first decade in business - Parkhouse Financial's doors first opened in late 2006! In particular, thank you for the significant amount of referral business that we received, especially throughout the last couple of years. We appreciate your support always and take that vote of confidence seriously. We always enjoy working with you and welcoming new clients too. You make our job fun!

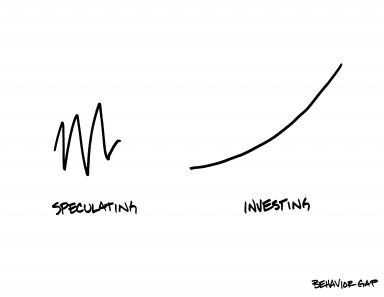

Investing in Uncertain Times

Investing in Uncertain Times

Generally, stock markets have acted very positively since Trump’s election…the so-called “Trump-Bump”.

Dear Friends & Associates,

Dear Friends & Associates,

We would like to share an article to add to this week’s reading list. Nathan was recently contacted by Yahoo! Finance Canada to provide his expertise on becoming your own banker - holding a mortgage in your RRSP.

We have updated www.parkhousefinancial.ca to better

We have updated www.parkhousefinancial.ca to better

reflect our philosophy, services and specialties.

Help achieve your retirement goals faster

Help achieve your retirement goals fasterMany Canadians are concerned they haven’t saved enough for retirement; however, they may be missing an opportunity to contribute to their RRSP.